are combined federal campaign donations tax deductible

Political donations are not tax deductible on federal returns. While tax deductible CFC deductions are not pre-tax.

Are Political Contributions Tax Deductible Personal Capital

Individuals may donate up to 2900.

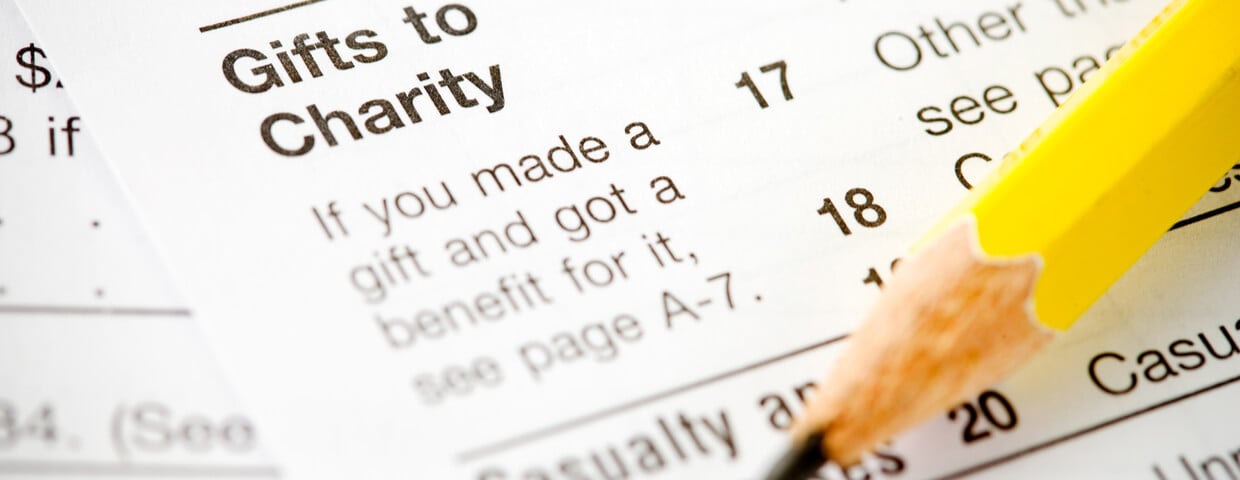

. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program. Thank you for contributing through the Combined Federal. Your tax deductible donations support thousands of worthy causes.

Through Combined Federal Campaign. Federal law does not allow for charitable. And since all participating recipients are 501c3 organizations you will enjoy a combined federal campaign tax deduction.

For our supporters employed by the Federal Government the Fund is also registered in the Combined Federal Campaign as Diplomacy Matters-AFSA and its CFC number is 10646. Last year the CFC. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates.

Are Federal Campaign Contributions Tax Deductible. Combined Federal Campaign Foundation Inc. Claiming a Credit for Federal Political Contributions.

Are Combined Federal Campaign Donations Tax Deductible. Overseen by the Office of Personnel Management OPM the Combined Federal Campaign is the official workplace giving campaign for federal employees and retirees. Generally a taxpayer is allowed a deduction for any.

If a donor makes a CFC payroll deduction are those contributions taken pre-tax or after-tax. Chesapeake Care Clinic is a 501c3 nonprofit organization and donations are tax. Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns.

Political donations are not tax deductible on federal returns. Your tax deductible donations support thousands. Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities.

The IRS which has clear rules about what is and is not tax-deductible notes that any contributions. While tax deductible CFC deductions are not pre-tax.

What Is The Combined Federal Campaign Article The United States Army

United Help Ukraine Unitedhelpua Twitter

United Breast Cancer Foundation Get Involved

Ways To Donate National Capital Greater Chesapeake Red Cross

Tax Deductible Donations Rules And Tips

How Large Are Individual Income Tax Incentives For Charitable Giving Tax Policy Center

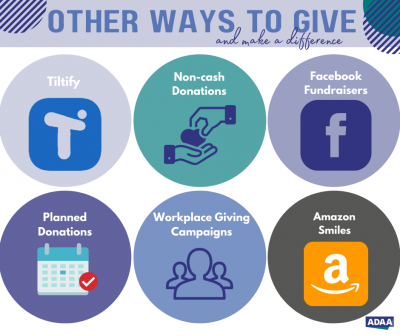

Other Ways To Give Anxiety And Depression Association Of America Adaa

Fec Candidate Who Can And Can T Contribute

Are Political Contributions Tax Deductible H R Block

Donate Multiple System Atrophy Coalition

Why The Cfc Combined Federal Campaign Of The National Capital Area Northern Virginia

Donate Help Your Local Community Volunteer Today

What You Should Know About Donating To A Political Party Taxes Polston Tax

Why Workplace Giving Matters America S Charities

Are My Donations Tax Deductible Actblue Support

2022 Combined Federal Campaign Fundraiser Underway Show Some Love Be The Face Of Change National Association Of American Veterans